CuriosityStream Update

Disclosure & Disclaimer: I own $CURI. This is not investment advice. Do your own research. You can lose money on securities.

In this post, we will discuss updates from my previous post:

- Price Action

- Q3 Update

- Guidance and Competition Q4s

- Final thoughts

Price Action

Q3 for $CURI occurred right after my previous post, and investors were initially bullish on the stock. As a result, they bid the price from the bottom of $1.21 USD on Nov 9 to a peak of USD 1.74 on Nov 11. This represents a 43% gain from base to peak.

However, as the year passed, the stock returned all the gains, ending 2022 at USD 1.14.

Interestingly, from 2023 onwards, the stock skyrocketed to an even higher peak of USD 1.86 on Jan 27 and remained elevated till February. This might be due to tax loss harvesting, although this is speculation.

Q3 2022 Review

On Nov 9, $CURI released their Q3 2022 update. The report is positive, and the thesis that $CURI is turning into a profitable company is still on track. $CURI is increasing revenue while reducing operating costs, reaping economies of scale. As a result, $CURI managed to beat the top-line and bottom-line analyst estimates.

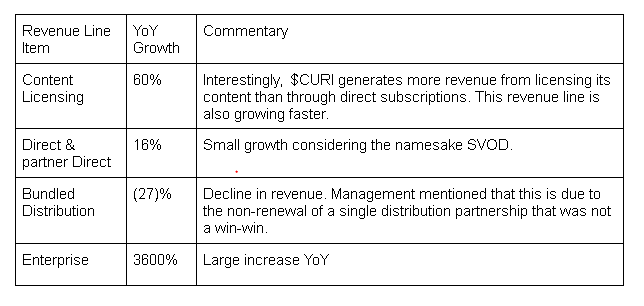

Diving deeper into revenue lines can help us understand the revenue increase.

On the other hand, we continue to see a reduction in operating expenses:

The biggest cost reduction is with marketing, with marketing expenses dropping 40% lower year over year. General and Administrative expense has been reduced by roughly ~2 million sequentially while increasing YoY due to legal, due to tax, accounting and legal personnel increases. As an aside, Curiosity Stream only has roughly ~92 employees. So I do not expect any significant reduction in cost due to layoffs. COGS has increased YoY, roughly in line with revenue, with gross margins decreasing slightly YoY and increasing QoQ. I expect that in the future, most of the cost reduction will come from marketing and a reduction in content spend.

However, on the other hand, there are some concerning issues:

- FCF outflow has increased sequentially while being down year over year

- Drop in subscriptions

- Devin Emery - Chief Product Officer, is leaving

Firstly, even though $CURI produced better than expected earnings before interest taxes and amortisation (EBITA) loss. As stated previously, accounting for amortisation for streaming companies isn’t ideal. Therefore, the most critical metric for the thesis is free cash flow. Unfortunately, Free Cash Flow outflow increased by 7M QoQ or increased 110% QoQ while decreasing 32.1% YoY. This is an important metric to watch in Q4 2022.

Secondly, the drop in subscribers is concerning. However, as stated above, management has mentioned this is largely due to discontinuing a partnership which undervalued the curiosity stream subscription. For now, it can be assumed it is a one-off event.

Third, it is always concerning when there is turnover in the executives. Devin Emery, the Chief Product Officer, is leaving for morning brew. He is still involved with $CURI on an advisory basis and is still on the board of directors of Nebula. Nebula is a creator-owned and operated streaming service closely partnered with $CURI. It seems like he left on good terms and more of a greener pasture thing rather than something wrong with $CURI.

Q4 2022 & Projections

During the Q3 2022 Conference call, CFO Peter Westley stated: "We generated over $10 million in fourth quarter content licensing revenue. In addition, last year's fourth quarter revenue included $2.6 million from the distribution agreement that we elected not to renew this quarter. Finally, we are pleased to reaffirm our expectation to end the year with at least $50 million of cash, restricted cash and available-for-sale investments.”

This implies an FCF outflow of 13.7M or less for Q4 since they have 63.7M in cash and short-term investment as of Q3 2022. This would mean a 56% decrease in FCF outflow YoY or that the FCF outflow roughly remains flat QoQ.

Profitability Projections

Management is also guiding that Marketing in 2023 will not have the same marketing obligations and that they will move to 100% performance marketing. They believe they can grow the subscription base at a lower marketing spend. However, they still have 6M in obligations for marketing for Q4, which is potentially foreshadowing they might not be able to be EBITA/FCF neutral/ positive in Q4.

Subjectively, I received much fewer advertisements of CuriosityStream from various YouTubers. They are indeed spending less on marketing. However, I’m concerned if they continue to grow revenue with such restricted marketing.

Growth Projections

In Oct 2023, the CEO of Nebula, Dave Wiskus, announced huge signed-ups for Nebula, corresponding to significant sign-ups for Curiosity Stream direct subscribers during the Q4 period. As an aside, Nebula - released their plans for 2023 to optimise their website, and I am still bullish on the prospects for Nebula. I, therefore, expect a reacceleration of direct subscription adds for Q4 2022, which has higher margins and higher ARPU.

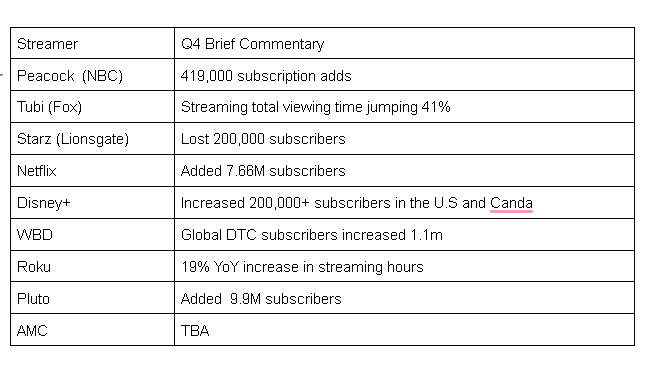

Many of $CURI’s competitors have already released Q4, which offers an exciting look into the media industry. Competitors include Roku, WBD, Para, AMC, Disney, and Fubo.

Streaming subscribers are growing, and the secular decline in cable & broadcast continues. This validates the report put out by Nielsen. This is mainly bullish for CURI as cord-cutting continues.

Source: Nelson.

Final thoughts

Short-term

Overall, I am satisfied with the stock's performance over the past three months, especially compared to the rest of the market. At the time of writing, $CURI doesn’t offer the same Asymmetric bet I previously wrote about when its market cap was 50M. The thesis is still on track. However, if it ever gets close to cash again, it represents a great purchase at those prices.

Currently, I think there are better ideas in the market. Nevertheless, there is still some meat on the bone. At the time of writing, the MC is $100M, and a fair value should be around $200M.

Long-term

On the other hand, this video from Warren Buffet has me thinking. He comments on the decline of newspapers and media. He argues that media companies are in the market for limited human attention and are no longer as monopolistic. Despite all the innovations, people cannot have more than 24hrs a day. Viewed in this way, the market is highly competitive, with social media and gaming competing for our collective eyeballs. Over the long term, I’m uncertain of the competitive advantage CURI would have.

Like my content? Please share and subscribe; Writing these posts is a lot of work, and I try my best to share my best ideas every quarter.