Inspirato - a potential 1 PE stock

What is Inspirato

Inspirato is a luxury travel subscription company. Market Cap at publication ~ 120M. Ticker - $ISPO. Disclosure & Disclaimer: I own ISPO shares, and this is not investment advice.

Inspirato (NASDAQ: ISPO) trades less than its NTM revenue at 0.35x Sales. ISPO is near its cash, at 0.41 Adjusted TEV/Gross, indicating the market believes that ISPO will collapse or go bankrupt due to continued losses. However, given the industry tailwinds in both the luxury and travel industries and a history of positive free cash flow generation. We believe the current unprofitability is only temporary. Furthermore, given primary research with actual customers, we believe ISPO has a strong product market fit.

Snapshot of Inspirato’s business, source: Inspirato

What is Inspiratio?

In short, members pay a monthly subscription to join the club and, in return, have the right to rent out exclusive luxury residences like this:

Example of one of Inspirato’s residences, source: Inspirato

On the demand-sie, Inspirato has three main revenue lines:

- Club ($600/month) - Simply the right to rent these luxury accommodations

- Pass ($2500/month) - “All you can eat” plan

- Select - Businesses, Charities and Customers can purchase stays with Inspirato and transfer them to employees, donors and friends/family.

Inspirato's supply side consists of three things to service the demand:

- Signing long-term leases for residences

- Partnerships with hotels

- Conducts member-only experiences and events.

A common misconception is that ISPO is a self-serve online travel agent (OTA ) or Marketplace like Airbnb, Expedia or Booking. Inspirato offers a higher touch and more consistent service compared to platforms like Airbnb; They are more membership focused and are akin to full-service traditional travel agents - they plan, book and arrange your holiday. The model is much higher-touch than the self-serve website model of OTAs and corresponds to a higher customer service cost. They would have an onboarding exercise to determine the member's details, types of preferred holidays, experiences and allergies, for example. A dedicated team of 4-5 would get to know the customer when they join the club. The destination manager would then arrange with personnel on the ground to execute your holiday. For more information, this podcast is quite enlightening: https://robbiekellmanbaxter.com/inspirato-brad-handler/

Valuation

Selecting of Valuation Metric

Inspirato is not profitable. So it won’t be relevant to use PE and DCFs to calculate the value of the business. Many analysts would often use sales since Inspirato is a post-revenue, growing company. On the denominator, it is unfair to compare high gross margin travel businesses like Airbnb, Marriot, and Expedia, which seem expensive on a price-to-sales basis, to lower gross margin businesses like Inspirato (due to its more capital-expensive & high touch model).

On the numerator, a better choice would be Total Enterprise Value (TEV) since much of the market cap is cash. TEV accounts for the net cash on the balance sheet and is a fairer price an “acquirer” would have to pay. On the liabilities side, $ISPO has no long-term debt other than capital leases. Due to recent GAAP accounting changes, companies must report capital leases as debt. This change is made so companies cannot hide significant liabilities in their capital leases. However, if we used gross profit as the denominator, we would double-count the capital lease if TEV included capital leases as debt.

In Inspirato’s case, capital leases are the real estate they rent from landlords and constitute a significant material cost. As they have already been paid, these landlords have no claim to the gross profits (our selected denominator). This is unlike typical capital-light tech firms - which may have little or no capital leases in their COGS.

Furthermore, their capital leases (like office real estate) are subtracted at the operational level. Capital leases would be relevant if we do use TEV/Sales since real estate owners will have a claim on the revenues.

As a reminder, the point of a valuation metric is to determine the price we pay for cash flows. For a scaling company, gross profit would be preferred over sales. This means we have minus cash from the market cap without adding the capital leases, which is a non-GAAP and gives us the selected valuation metric for ISPO - adjusted - TEV/ Gross.

As of Q3 2022, the Adjusted TEV/ Gross Profit is ~ 0.41. This is compared to an average of 5.8 for selected competitors in the Luxury, OTA, and hotel industries.

Source: Compiled by myself

Another thing of note is their dual-class structure. There are 58,873,840 shares of Class A Common Stock and 65,196,419 shares of Class V Common Stock, and 8,624,792 Warrants. Many stock informational websites incorrectly calculate their Market Cap as they do not factor in the Class V common stock. Class V can be converted into Class A and holds no economic value.

Business Model

Attractive Business model:

- Recurring subscription revenue.

- Float / Negative cash conversion cycle. Customers book trips months in advance before ISPO has to pay suppliers.

- A customer loyalty program is a profit centre compared to a loss centre for other companies. For example, Amazon Prime & Ikea’s loyalty programs are loss centres that attract customers to spend elsewhere.

Moats:

- 2-sided platform. It has slight network effects; a large number & variety of residences attract more customers, which allows for the expansion of residences / higher rate ISPO can offer house owners.

- Exclusive residences not found on other platforms

- Executional Moat - data-driven

- Lower cost of capital & Funding Cost- $ISPO can tap into their affluent customers compared to banks for a sales leaseback situation. Traditional hotels get squeezed by real estate investors like black rock. To facilitate $ISPO has created a new division - Inspirato Real Estate.

- High Capital Cost - To match the same network of houses, a competitor would need to spend considerable capital to enter.

Optionality:

- ISPO has the benefit of having rich customers - they can sell luxury goods in the future. They recently announced a partnership with Saks, a prominent luxury departmental store operator.

Product Market Fit & Product

This section attempts to answer whether the ISPO product is good. In general, the Unique selling points (USP) are:

- Affordability. Pass shapes / Redirecting demand to the low usage period

- Consistent Service - no vacation roulette

- Taxes and fees

- Spread cost evenly over months

- Hassle-free - trip planning

What do customers say about Inspirato? Management uses NPS as a KPI,

$ISPO also has a retention rate of 83% annualised retention (BoFA 2022 Securities). Management will start to report figures next year and has not done so, supposedly because covid messed up the numbers (mentioned during Citi 2022 global technology conference). $ISPO has an LTV/CAC of 4 - https://www.sec.gov/Archives/edgar/data/1820566/000119312521204081/d17118dex992.htm

Industry Statistics:

- Occupancy - 80-90% (atypical for luxury hotels) - average 60-70

- Average (Daily rate) ADR - 1800 for $400 a night.

I also interviewed customers and found out that most people would recommend the service.

Growth

In the following section, I will discuss market trends and potential growth vectors $ISPO can tap into to grow.

Market & Trends

Inspirato is in an exciting position in the investable universe with strong secular trends.

Firstly, with the rise of technology, globalisation and the financialisation of the world. The rich are getting more prosperous due to the considerable leverage an individual has at their disposal. Societies all around the globe are increasingly getting more unequal. Each person becomes more productive; we can produce more with less. The most productive of us become will widen the gap due to leverage, so the number of luxury customers will continue to increase. The World’s current richest man is Bernard Arnault, the co-founder, chair, and CEO of LVMH. Secondly, the increase in entertainment demanded by consumers will also increase. As the economy becomes more productive, there is more and more time for activities to be dedicated to productive uses - leisure activities. Information technology like the internet and smartphones have increasingly made the world more productive. AI is increasing this trend further. Covid has made remote working much more mainstream, allowing for more flexible working locations.

This has resulted in a secular trend from goods/products to experiences. This secular trend already started before covid - with millennials and gen Zs looking for unique experiences compared to material goods. During covid, when everyone was locked down, there was a temporary reversal towards purchasing goods - furniture, laptops, cars - which resulted in a massive run-up in companies like Peloton and RH. However, post covid - consumers have swung back heavily towards experiences - trends like revenge travel have dominated headlines for the past few quarters. In the future, more and more consumer dollars will be spent on experiences compared to goods. Particularly within the market of experiences - travel is a large and growing piece. Travel is often seen as an ultimate experience afforded to the rich (although increasingly becoming more mainstream) that consumers are willing to pay for and withhold spending on other discretionary sectors. In fact, due to remote work, more and more people can travel the world. Deloitte predicts that the young and rich will lead the way for 2023 in this industry outlook.

Within the travel industry. There are three large markets - experiences, transport and accommodations. Within the accommodations industry - vacation homes are the hottest part of the industry. Players like Airbnb, Vacasa, VRBO, and Sonder are new players who are expanding the market/ taking market share from traditional hoteliers. Leisure travellers prefer the larger space, privacy and extra amenities that vacation homes offer, such as kitchens and lounging areas, compared to a standard hotel room. Vacation homes offer better value, especially for larger groups. Business Travellers still prefer the consistency of brand-name hotels. For the rich, vacation homes have always been the norm due to the privacy it offers. Since the rich/powerful can travel, the rich and powerful have been purchasing vacation homes/palaces in vacation spots in faraway lands. The model then shifted to pooling capital for shared ownerships such as timeshares. However, timeshares lack variety, resulting in the creation of resort memberships like exclusive resorts. According to the $ISPO founders, $ISPO is the natural progression of the industry. Besides the accommodation market, $ISPO is also participating in the experiences market, hosting unique events like cruises and planning the holidays for their wealthy clients.

However, the travel industry is also cyclical, resulting in periods of boom and bust. Due to rising demand and inelastic supply, the price of travel accommodations will therefore increase. As a result, the industry builds more rooms to take advantage of the higher prices. The significant increase in supply then lowers the price, inducing a downturn, which reduces spaces, restarting the cycle. The airline industry is notoriously unprofitable. After the Great Financial crisis, the travel industry had a bull run for ten years, which ended in a massive bust during 2020 - during covid. In 2023, we are still in the early stages of a travel boom, which will likely last a few years. Asian outbound travel is likely to sustain the demand from 2023 - 2024.

ISPO growth vectors

- Inspirato can grow by raising prices.

- Qty of nights stayed.

- Qty of members

- Launch of new product lines

- Over the long term - Internationalisation

With an LTV / CAC of 4, there seems to be room to increase marketing spend to grow faster.

Supply Growth

In general, and per management guidance, it is much harder to increase supply than demand. However, management has stated that the supply side rarely leaves (2022 global technology conference). Furthermore, they said in the BoFA 2022 Securities that there are many inbound offers due to the network effect. There seems to be a product-market fit for high-network individuals owning Luxury vacation homes - they don’t want to be bothered by their vacation homes for the rest of the year. Developers/ PE is another supply source, albeit with less negotiation power.

Management & Culture

The business model is more important over the long term. However, in a short term, the management factor is significant. The brothers founded Exclusive Resorts and are still executive team members.

Management seems to be competent. Brad Handler, the CEO and Founder, appears frank and sometimes humorous in podcasts and media appearances. According to himself, he excels at early-stage product development. He has deep expertise in the area, being around Luxury Real Estate for the past 20 years. Interestingly, $ISPO is a revenge startup because the billionaire that acquired his previous startup kicked him out of the last company (Exclusive Resorts). That would certainly provide a lot of motivation to scale the company. A good interview to watch is this.

The essential resource for a company is its human resources. As for the culture, management has described the culture as data-focused and membership-focused.

On glassdoor, they receive a 3.5/5, which is concerning and a potential red flag. Many people mention the low pay and the recent layoffs as reasons for the low score. An attractive perk is that employees get a free trip they can take as if they are members of the actual club, which is also commonly mentioned in the reviews on the glass doors. That is sure to win over the support of family and friends.

Profitability Concerns

The elephant in the room is profitability concerns. Will Inspirato ever become profitable? If so, when?

Unit economics discussion

The bear argument mainly argues that ISPO is structurally unprofitable. They point out that ISPO is similar to the infamous Moviepass - customers that stay behind are also the least profitable. The argument goes that ISPO will consistently discount houses more than their worth. The bear thesis mainly targets the Inspirato Pass part of the business, a material proportion of the revenue, which is the subscription allowing for “all you can eat” travel. ISPO also partners with hotels, like Movie Pass with theatres. Similarly, Luxury hotels have high spoilage during non-peak periods like theatres.

However, unlike movie theatres, luxury hotels would let their rooms spoil ( industry term for remaining unbooked) rather than lower prices. Due to the opacity of the price, ISPO is able to monetize a non-monetizable asset for hotels, resulting in a win-win. Moviepass, on the other, does not provide similar value to theatres that already rapidly discount prices during non-peak periods.

Furthermore, unlike Moviepass, Inspirato controls its supply. ISPO can select undervalued properties for its controlled properties, given they know the cash flow will be coming in compared to individual HNW (high net worth) property owners or institutional owners. They control these properties (lease) but do not own them. In a way, it can be seen as an investor with asymmetric information in luxury real estate without exposing themselves to the real estate cycle & risk. They can choose properties whose lease payments make economic sense.

Secondly, the luxury residential market is not a commodity compared to a blockbuster movie ticket. Each house has different amenities, locations etc., compared to the commoditised right to watch a movie (referring to a movie ticket). This ultimately means ISPO has some negotiation power with consumers compared to movie passes. Customers may choose to pay up to stay at a specific location at a specific time with specific amenities.

Thirdly, as mentioned earlier, other revenue streams are profitable compared to the pass revenue line. I do not see any issue with Inspirato Club and Select. Inspirato Club is simply the right to purchase a stay at a $ISPO affiliated property (potentially discounted). Similarly, Select adds the ability to give that right away, improving the ecosystem's value.

Fourthly, there is an optionality for $ISPO pass to make it profitable. Inspirato should be able to pull levers to shape demand better to direct remote and flexible-minded travellers to less demanded locations and timings. Pass has a mechanism to reduce usage called pass days. Each room is priced in “days”, and after each reservation - the user cannot book again until the number of days has passed. This obfuscates the pricing for customers. Inspirato can adjust pass days to balance the value customers get and make the unit economics work.

Fifth, operating in the luxury market has its advantages. Price is largely not an issue. Instead, quality, exclusivity, value and privacy are more important. I’d argue that $ISPO has the pricing power to increase prices as there are few similar competitors' offerings, and customers love the product. From user interviews, they rave about the value it provides them.

Past Evidence of profitability

Other than analysing the unit economics and imagining a potential future, we can also look at the past for clues to ISPO profitability.

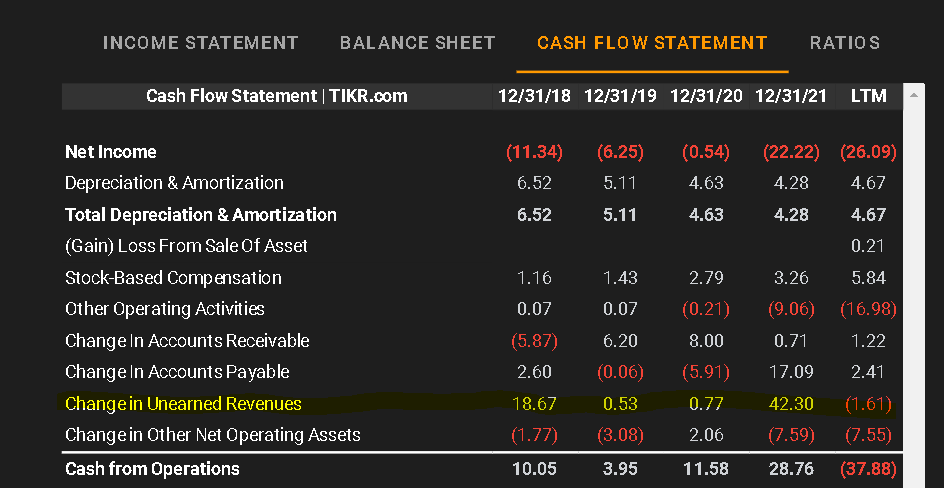

A curious fact was that ISPO was FCF-positive in 2021 at a 10% yield. However, they were not GAAP profitable in 2021. This is because of the float situation mentioned above in the business model section, where they have consistently gotten more bookings and only have to pay out landlords later. As $ISPO has grown, they have generated cash simply by the superior cash cycle.

Being a previously VC-funded company, we can see that they last raised capital in 2014 - raising 80M in cash in venture capital. In 2021, the year of the IPO, we see they also have 80M in cash. This means they were largely CFC-neutral in the past seven years. Although, this could be because they have been paying employees via stock-based compensation and other reasons.

Management has also stated previously it was FCF-positive in podcasts before the IPO. The IPO is likely to liquidate even for early investors and to raise capital for expansion. Due to revenge travel after covid, there was a surge in demand in H2 2021 and H1 2022. Management has stated that due to installation and re-decoration, this had a resulting drag on gross profitability.

All these point to the fact that ISPO is free cash flow positive, which is a step before being GAAP profitable. In 2020, they were the closest to a net profit.

Future Profitability Projections

A significant concern is a recession and inflationary fears. Many participants predict a recession in late 2023 or 2024, and there has already been a white-collar recession in the tech & finance industry. Inflation, on the other hand, has been high in 2022. The typical understanding is in a recessionary and inflationary period, with lower earning power and rising prices, consumers will forgo discretionary items like travel.

However, if we study the inflationary period in the 1970s, people have continued to travel during inflationary periods, especially American consumers who view travel as much less discretionary.

Furthermore, the rich are much less likely to reduce travel than the typical American consumer. Bill gates has increased his stake in Four seasons.

Conservative profitability calculation

If ISPO can achieve ~10% FCF yield as it did in 2021. In Q3 2022, management forecasts about 20% growth in 2023, which will result in roughly ~$400m rev in 2023 (350M rev 2022E). 10% of 400M means about 40M in FCF. with increasing scale and efficiencies; the FCF yield can potentially be higher. A market cap of 130M and 80M in cash results in 50M in adjusted market cap. This implies a yield of almost 80%, meaning an acquirer's payback period would be 1.2 years. Compared to the typical 5% yield (or 20PE) typically demanded in the public markets.

Management has guided at the BoFA 2022 Securities conference that he expects a long-term gross profit margin of roughly ~40% and an EBITA margin of 10-20%. So I believe my projections are not too out of line.

Management also has laid off 12% of their workforce, which might push them over the line into operational profits.

Law Suit risk

In November-December 2022, ISPO restated its financials due to incorrect application of accounting standards. I'm no lawyer, but this might be a nothing burger. You need to be

- U.S. security law is on a disclosure basis

- Management has disclosed control & procedure issues

- Accounting Mistake is immaterial and/or even beneficial to stock price since it actually overstated COGS

- It Likely has D&O insurance - so immaterial effect anyway

Insider purchases

Kallery David - the President of ISPO, purchased 36,000 shares at $2.88. At current prices of ~$1.1, it's more than half the price at which Kallery purchased.

Millennium Ventures, a VC firm, recently tripled its stake, owning 9.8%. They have been with the company long since the VC days and have a duty to produce VC-like returns for their LPs. This implies they expect ISPO to deliver VC-like performance at current prices.

On the other hand, VCs have sold out of their stake. So take it as you may.

Why is the stock cheap?

If we can speculate why the stock is cheap, it perhaps provides a narrative and confidence for investment if it is not rational.

- Unprofitable & Unique business model - ISPO is not an OTA or a traditional hotel. Difficult for investors to value the business.

- Tech & Spac stock - Almost all tech & SPAC suffered in 2022. Other travel/tech SPACs like Sonder, Up, and Vcasa has seen their price cratered. ISPO has a differentiated model compared to the aforementioned startups, but it might be easy to lump all these companies together.

Conclusion

Inspiranto operates in a compelling market but has profitability concerns. They may be trading close to a 1 PE valuation if they can be profitable.