The Tesla Inside™ Intel

Part of my series for my Intel Investment Thesis. Talking about a little known self driving chip company called MobilEye

(this is part of my series for my Intel Investment Thesis)

MobilEye is a low-key and unknown company to most people outside of the industry. However, they are arguably an awe-inspiring self-driving company. The market has seemingly agreed that Tesla has won the race with a 1.13T market cap (April 2022). I have been a bull and stockholder of Tesla ever since 2017. I understand the bull thesis clearly and would like to demonstrate how MobilEye has similar or better advantages.

Context is required to understand the market. Both Tesla and MobilEye subscribe to the Advanced Driver Assistance Systems(ADAS) strategy - where FSD (Full Self Driving) is just an advanced ADAS. While the rest of the industry believes the problem is different enough that it needs a dedicated solution and feels progressively improving ADAS is unsafe.

Tesla Bull thesis point 1

Teslas Data collection advantage - Modern Neural Nets require a large quantity of high-quality data. Key advantages Tesla has over its Robotaxi competitors is that it:

- collects way more data faster - 22 million miles collected, more than all other competitors combined

- cheaper - customers who pay to test software instead of paying for expensive technicians and cars like their competitors (like Waymo, Cruise).

- And most importantly - much more variety. with its customer's fleet. This is a much-needed tool to solve the long tail of random situations an Autonomous Vehicle (AV) might face.

As a result of this advantage, Tesla can continuously feed its Data Engine to improve its FSD (full self-driving) software and roll it out in Over-the-air (OTA) updates.

Do you know who else has this advantage?

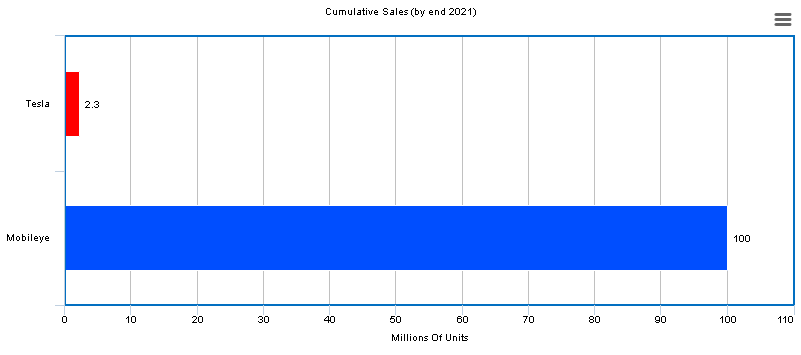

MobilEye. While Tesla has shipped over 2.3 million cars, MobilEye has shipped over 100 million chips. Almost 50x more systems in the wild.

If your car has ADAS, it is likely running a MobilEye. Although they do not collect the video wholesale like Tesla, they do collect compress and only upload "semantic information". For more information click here: link.

Mobileye Data Services collects a wide variety of roadside information, including road markings, road slope, traffic signs, potholes, road cracking, traffic flow, near-miss incidents, harsh braking and harsh cornering ratio plus much, much more.

On paper - they do this to create maps with their "REM" technology. However, if you look at the fine print - they also detect near miss, hard braking and harsh cornering. These are triggers for interventions - I'm sure the engineers at Mobileye use that to iteratively improve their algorithms, just not Videos wholesale like Tesla. It would be dumb not to.

Unlike Tesla, Mobileye also collects data for mapping.

Mobileye’s Road Experience Management (REMTM) is an end-to-end mapping and localization engine for full autonomy. The solution is comprised of three layers: harvesting agents (any camera-equipped vehicle), map aggregating server (cloud), and map-consuming agents (autonomous vehicle).

Read more about Mobileye technology: link

Elon famously dissed detailed maps (Elon Musk Declares Precision Maps A "Really Bad Idea" -- Here's Why Others Disagree (forbes.com)) like those needed by Waymo and Cruise. He argues they are impractical as:

- to scale as the companies mentioned above will need to pre-map the roads.

- The logic follows that Pre-mapping will make the FSD algorithm fragile as it depends on past HD maps, which might not reflect current reality.

MobilEye evidently has the scale to constantly update the map and at the point of writing, they process eight million miles per day. Its maps take the middle approach - not highly detailed and fragile point clouds like the Robo-taxi guys but essential information that the car needs to "remember" to make decisions. So they largely agree with Elon's side of the argument. With millions of vehicles, their map is frequently updated, and they are on track to map the whole world. Without a map - the vehicle has to determine the rules and perform SLAM (Simultaneous localization and mapping) correctly and at run time:

- a massive challenge with finicky AI

- with an accompanying compute cost at run time.

For example, there are multiple videos of Tesla FSD beta test drives running red lights (example). Tesla FSD can't remember where the lights are - they have to find out each time. On the other hand - MobilEye generates the map off-site in a server before runtime and saves precious in-vehicle compute and latency. Mapping also gives MobilEye another revenue stream

Tesla Bull thesis point 2

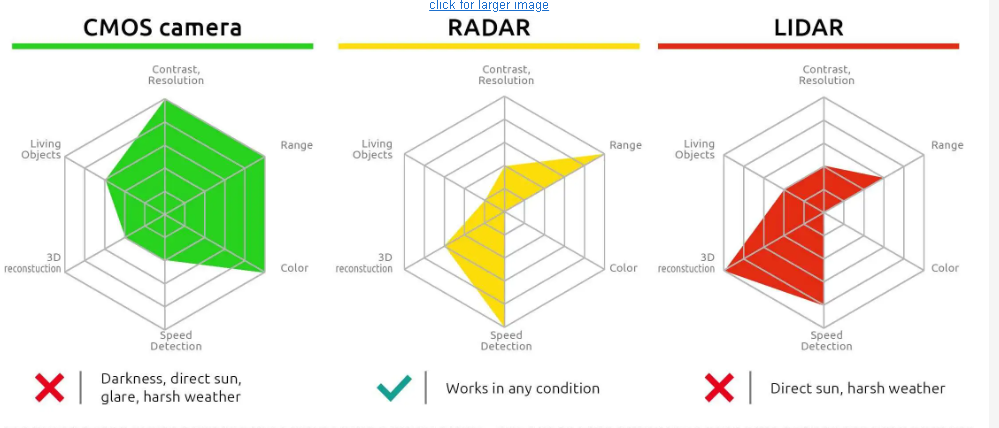

Tesla is famous for focusing on vision compared to Lidar. The argument is that Lidar is unnecessary for the driving task, expensive and ugly. Recently, Tesla even removed Radar because it conflicts with vision. Tesla argues that Radar is a lower fidelity sensor. Therefore, the algorithm will trust the camera rather than the Radar because of the additional context when it comes down to it. It is strongly suspected that removing the Radar also allowed Tesla to ship more cars with the chip shortage (link). Removing all other sensors allows Tesla to focus purely on cameras instead of "distractions & clutches".

Do you know who else strongly favours vision?

MobilEye.

Their ADAS runs exclusively on vision; they were even the ADAS supplier for Tesla before they decided to build their own.

From the outset, Mobileye’s philosophy has been that if a human can drive a car based on vision alone – so can a computer. Meaning, cameras are critical to allow an automated system to reach human-level perception/actuation: there is an abundant amount of information (explicit and implicit) that only camera sensors with full 360 degree coverage can extract, making it the backbone of any automotive sensing suite.

It is this early recognition – nearly two decades ago – of the camera sensor superiority and investment in its development, that led Mobileye to become a global leader in computer vision for automotive.

Let me repeat that - Mobileye has been focused on Vision for 20 years - older than Tesla itself.

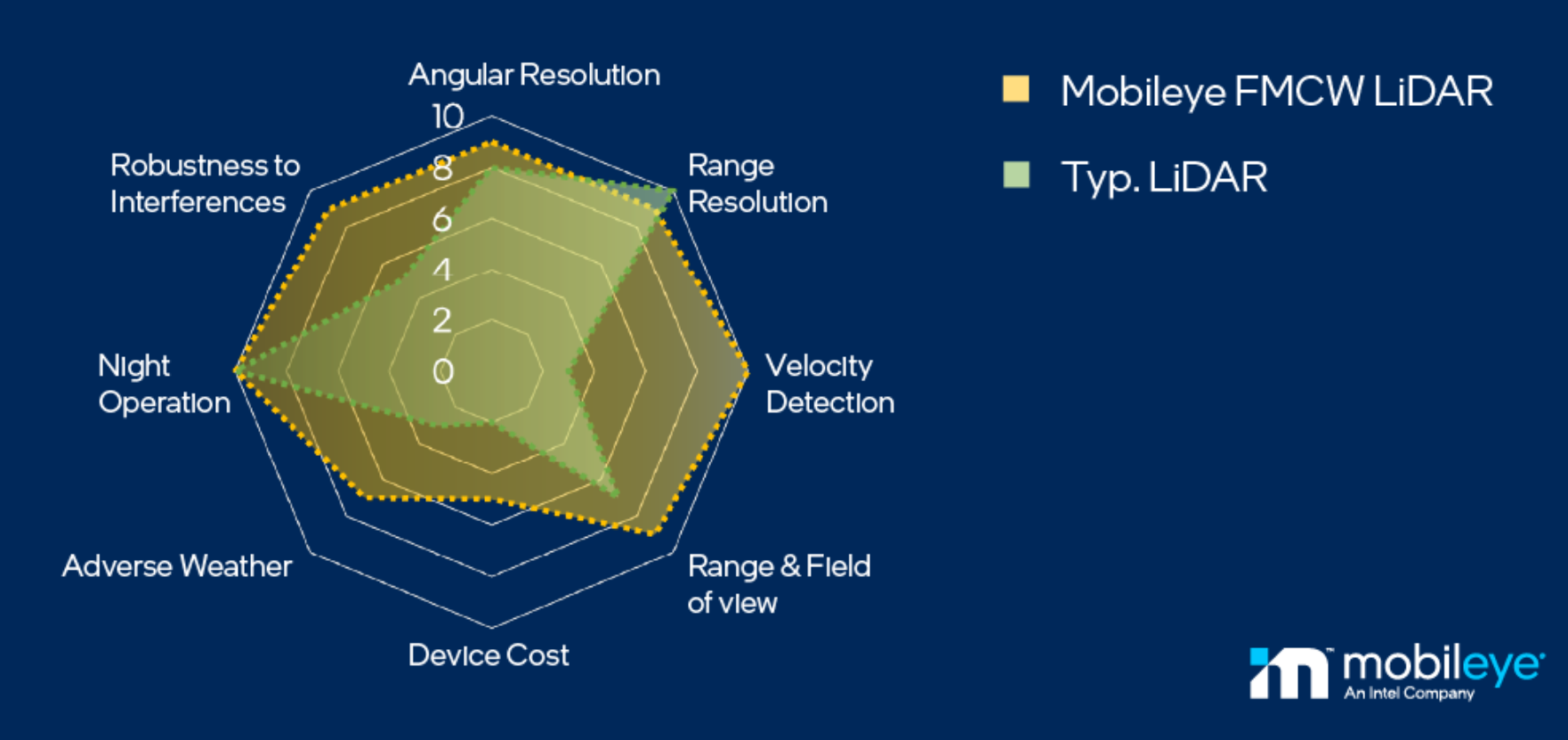

However, unlike Tesla, it hasn't ruled out using the Lidar & Radar. MobilEye plans to make a Radar and Lidar subsystem independent of Vison. MobilEye hopes to increase reliability by making a redundant system - inspiration from the aerospace industry (like the Tesla structural battery). The claim is dubious as it assumes failures are independent (insert link). However, it is right that Lidar and Radar have specific advantages over cameras (see below).

These other sensors will be useful for like seeing through fog, rain and low light situations which cameras struggle with. Furthermore, because of Intel's leadership in photonics, we have game-changing next-gen Lidar and radar tech.

Intel has a wealth of experience in developing software-defined infrastructure that forms the basis of our new radar. It also has the rare silicon photonics fab to integrate both active and passive components onto a single chip to underpin our LiDAR.

Furthermore, the new next-gen Intel Radar can extract many more channels than traditional Radar (2304 channels) as compared to the 8 channels Tesla uses. A 288x times improvement.

Tesla was using a Continental ARS4-B radar, which was a perfectly good radar...in 2014. Since then, radar technology has come on a long way. One measure of a radar's potential imaging performance is the number of virtual channels it has. This is the product of the number of transmitting channels and the number of receiving channels and is analogous to the number of pixels in a camera. The Continental ARS4-B used by Tesla had 8 virtual channels (which was the norm in 2014). Since then, the industry moved to 12 virtual channels, but the latest radars from Continental have 192 virtual channels. Start-ups like Arbe and Uhnder and others covered in "Automotive Radar 2022-2042" have upwards of 200 virtual channels, with room to grow to over 2,000.

Read more here: Tesla Dropping Radar Was a Mistake, Here is Why | IDTechEx Research Article

Next-gen high definition Radar is a game-changer and will genuinely compete/ complement cameras with essential advantages useful for the driving task:

- measurement of speed directly via the doppler effect instead of needing to infer it from a neural net,

- Ability to work in all weather conditions

- Ability to detect metal (which Teslas cars repeatedly crashed into & caused injuries & deaths)

Tesla's argument primary thinking process for eliminating these other sensors is Biomimicry - Humans are the only creatures known to be able to drive a car well. Humans do not have lasers or Radio waves coming out of our eyes and, therefore, cars do not need either. However, this logic is flawed and close-minded, as the best design might use a different underlying principle and not be a wholesale copy.

Planes, for example - even though inspired by birds - do not have flapping wings.

Most experts agree that FSD is primarily a software challenge, MobilEye too; however, companies can and should use every tool in the tool build to speed up development. Technologically, these new sensors are solid-state - meaning these sensors will be low cost and reliable (under $1000). Economically, it is well worth the cost as they can be amortized over 100k rides in a taxi application. Tesla's argument that Lidar / Radar is expensive will be proven wrong in the coming years.

Tesla Bull thesis point 3

Both MobilEye and Tesla plan has the most aggressive rollout plans. Telsa hopes to be able to flick a switch and turn its fleet of Tesla cars into Robo Taxis in potentially their Tesla app. Supposedly the most significant increase in value globally (Cheaper than bus tickets: Musk says FSD to deliver "biggest increase in asset value" in history (thedriven.io)). However, I have not seen how they will attract riders to use their app. The mobility space is much bigger than just Uber and Lyft 8 years ago. There is micromobility, public transport and the rise of super apps that integrate food delivery.

MobilEye, via their ADAS products in deployment, has formed partnerships with vehicle manufacturers & startups. They even have numerous design wins, forming quite a bit of an ecosystem/ platform that can produce a variety of vehicles.

Mobileye has agreements with six OEMs, including BMW, Nissan and Volkswage

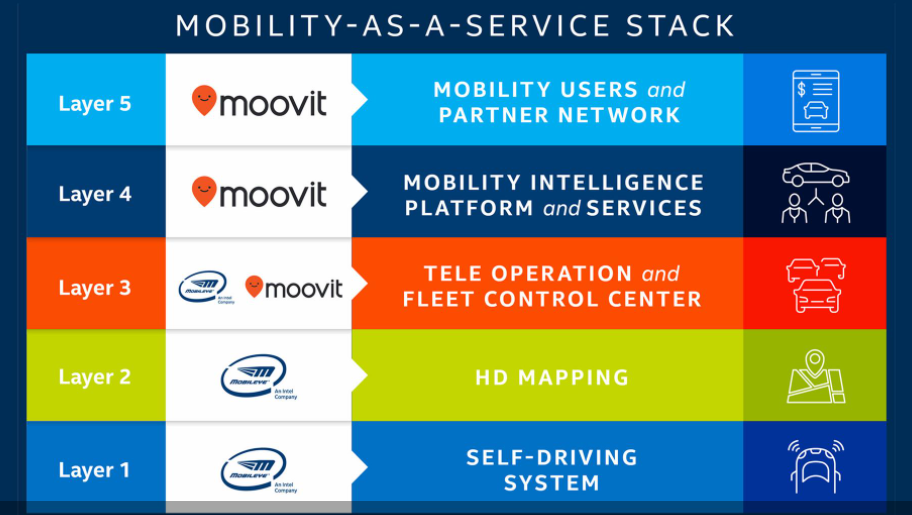

And they have Moovit.

In 2012, Moovit launched as a free app for iOS, Android and for Web browsers to guide people in getting around town effectively and conveniently using any mode of transit. Over the years we’ve grown to now serve over 1.3B riders in 3,500 cities across 112 countries, in 45 languages.

We help people change the way they consume mobility by fully integrating all forms of transport, including all modes of public transit, local bicycle services, ride-hailing (Uber / Lyft), scooters, car-sharing, carpooling, and more into the Moovit app. The Moovit app combines information from public transit operators and authorities with live information from the user community to offer travelers a real-time picture, including the best route for their journey

Short of acquiring Google Maps, Moovit is the next best alternative. Moovit is sort of like specialist Google maps for all things mobility or Mobility As a Service (Maas). Think of it as google maps minus yelp. It already has 1.3b users, probably from their white-label apps.

This unique integration with an existing use case (public transport, ride-hailing and micro-mobility) positions MobilEye to seamlessly roll out AVs in the winder mobility revolution.

The implications of Moovit cannot be understated, and it gives MobilEye the following advantages:

- Moovit allows MobilEye to create & capture value at the much more lucrative network & fleet level. Routing AVs will be more challenging - cleaning, charging, accessible routes for the FSD software, and cell connectivity will need to be considered compared to human-driven vehicles which have human drivers who do that. Having better routing will increasingly be a competitive advantage by itself. This also represents potential revenue streams to interested parties - cities, other companies etc

- Being closer to the user will allow MobilEye to generate higher-margin software and subscription revenues. They will be a middle man between fleet operators and customers. This positions MobilEye to be a competitor to Uber and Lyft

- (Speculation) Enables a platform play. Think of Android - but Mobileye provides both the chips (e.g snapdragon), the OS (e.g android) and services (e.g google play). OEMs - focus on building cars, trucks, buses, lorries... the Moovit network will only have EyeQ vehicles (sorry Tesla, Waymo and Cruse).

Nir Erez - Founder of Moovit of where Moovit will go.

Tesla Bull thesis point 4

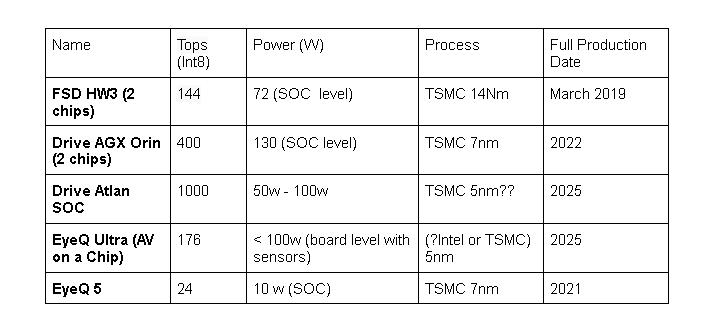

Tesla often lauds its custom hardware. For example, with its FSD computer, Tesla claims to be far ahead in performance and energy efficiency compared to Nvidia due to the optimization of its NN architecture.

What is surprising is that Mobile Eye is even more energy-efficient than Tesla but less performant at least in terms of flops. Instead of using general-purpose computing like Nvidia or Xeons like Waymo. MobilEye gives up even more flexibility for an Application Specific Integrated Circuit (ASIC) approach. The EyeQ ULTRA AV on a Chip is their 7th Gen SOC, while certainly fast, the comparative lack of FLOPs is interesting because it means the compute isn't that optimized for NN. MobilEye feels it is confident it can lock in its algorithms. It remains to see if it's a fool's courage or a calculated bet.

But perhaps the most interesting thing about the EyeQ Ultra is that Mobileye intends to do L4 driving with a chip that is, on paper, not particularly powerful. The official performance figure for the chip is 176 TOPS, which to be sure, is a lot of performance today (in 2022). But it’s is a fraction of the performance that’s planned for high-end SoCs in the 2025 timeframe that Mobileye is targeting. In short, Mobileye not only believes that they can do L4, but that they can do it at a fraction of the performance and power consumption of their competitors.

Ultimately, the argument that Mobileye will be coming to market with is that autonomous driving has matured enough as a field that not everything needs to be done in software or in highly flexible accelerators. Instead, it’s time to start building true ASICs, with highly specialized fixed-function (or otherwise limited flexibility) components that do one thing, and do it well. Overall it’s the natural path of progression for most task-specific processors, and Mobileye believes that self-driving automotive systems are finally ready to head that direction as well.

Read more here: Mobileye Announces EyeQ Ultra: A Level 4 Self-Driving System In A Single SoC (anandtech.com)

However, the small size of the die allows MobilEye to keep the size and number of chips low, resulting in the total cost of computing being under $1000. MobilEye's solution uses a tiny amount of power, extending AVs' battery life, which surely is an advantage when convincing vehicle architects.

Tesla Bull thesis point 5

It's a revenue generator now. It's funny that this has to be a bullish point, but many players in the Self-driving industry have pie-in-the-sky business plans. Billions are pumped into it, with token revenue/ trials.

The ADAS strategy allows both Tesla and MobilEye to be revenue-generating. In addition, both are shipping products to real users providing value now:

- Safety - saving countless lives and avoiding costs and injuries

- Peace of mind for long road trips and highway driving

The stability of cash flow is an unstated financial advantage that allows both to provide value now as they run the long marathon to FSD. As the industry consolidates - they will be cash to pick up any interesting teams & technology

More importantly, they have read products in the hands of users. Allowing them to have a disciplined design, prototype and test cycle. With real users, the rate of innovation is much faster and creates real value.

Technical Conclusion

In Conclusion, MobilEye has similar bullish points as Tesla. However, instead of locking themselves into technical decisions (Lidar / Radar), business decisions (consumer AV). MobilEye has straddled all solutions. Most importantly, with Moveit, it brings MobilEye closer to the customer. It allows them to simultaneously capture more value and provide more value to Vehicle Manufacturers. It is hard to find a more well-rounded strategy for Self-Driving.

Financial Implications

MobilEye comparables are:

- Tesla (1.13t) → Consumer AV

- Nvidia (800b)→ FSD Robo driver chip & software provider + infotainment

- Waymo (rumored 100b) → pureplay RoboTaxi

- Uber (63b) → super app, aggregator (Moovit)

- Luminar (10b) → sensor provider for autonomous cars

MobilEye is rumoured to IPO at 50 billion, almost 1/4 of intel's current valuation.

With MobilEye currently in Intel, it isn't easy to communicate to semi-conductor investors, and it's not visible to the broader market. In addition, Intel hasn't been doing an excellent job in communicating MobilEye's technical dominance.

With the MobilEye IPO, improved visibility, communication, and independence to create an AV future, I believe MobilEye's market capitalization will grow in time. Even expanding to 100b and beyond. Intel would still retain a controlling stake MobilEye, and it may be a good proxy trade to get exposure to MobilEye.

Amnon Shashua, the CEO of MobilEye, has launched a new digital bank in Israel - the first one in 43 years, currently valued at 300m+. He isn't someone to scoff at and is undoubtedly a very ambitious individual on track to head two unicorns (like Elon and Jack Dorsey).

(speculation: potentially speaks to his future ambitions to combine Moovit with a Digital bank)

Further Optionality with Intel in the Auto market

Suppose Tesla is like the apple of the self-driving car market. MobilEye is more akin to Android. It is unfair to compare the metrics as they have wildly different business models. MobilEye's actual competitors are Nvidia, Qualcomm, and potentially AMD.

Each 3 of them has different strategies. MobilEye concentrates on ADAS, and it is by far the leader. Nvidia is focusing on self-driving with their Hyperion platform & infotainment. Qualcomm is focusing on connectivity, allowing manufacturers to pick and choose solutions. Although not explicitly targeting automotive, AMD has great embedded CPUs with console-level graphics - even Tesla utilizes AMD processors in their cars.

With their strong beachhead in ADAS, I believe there is an untapped opportunity for Intel/ MobilEye to offer infotainment chips. Tesla previously used Intel before switching to AMD. Combined with advanced packaging & Arc graphics, Intel can compete in the infotainment market. Intel has a significant upside in car infotainment, with around 80m cars shipped annually.

The Acquisition of Tower Semiconductor provides Intel further optionality in the automotive segment such as BMS. The BOM cost of semi-conductor expecting to triple, growing from 6% to 20%. The Intel Foundry Servies is a beneficiary of this.

If you enjoy this, please subscribe to the newsletter! Or let me know if you enjoyed it!

Good sources:

Intel Lidar - https://m.youtube.com/watch?t=3083&v=B7YNj66GxRA&feature=youtu.be